The Curious Case of HSI’s Disappearing Debt

We recently added some new Humane Society of the United States tax returns to the HumaneWatch Document Library, including those of its affiliates the Fund For Animals, Humane Society International, and Humane Society “University.”

We read Humane Society International’s 2009 tax filing with particular interest. You might remember that last year Charity Navigator described HSUS’s global arm as “insolvent,” since it was carrying a 11.7 million debt on its books. The respected charity watchdog service gave HSI an abysmal “one-star” overall rating.

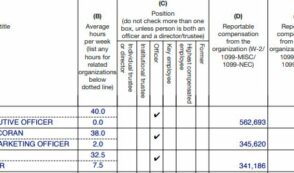

Like most crushing debts, Humane Society International’s gradually accumulated over many years. Through 2008, the group had a consistent revenue stream of between $2 million and $3 million per year. But in 2009, HSI suddenly catapulted itself into a new earning category, reporting nearly $20 million in income. (See page 1, line 8.)

And its Grand Canyon of debt vanished.

How can that happen? Is Humane Society International getting some sort of government bailout? Were they just “too big to fail”?

It’s worth a closer look.

Tax returns from the HSUS family of organizations tell a fascinating story if you know how to read them. In 2008, when HSI was still deep in the red, the group declared on its tax return that it owed $13,031,270 “due to/general fund.” And on HSUS’s 2008 form, HSUS lists the same exact dollar amount as a “reimbursement paid by other organization [HSI] for expenses.”

So this appears to be a “liability” from HSI to HSUS—money the international arm owes the mother ship. By the end of 2009, this figure had been reduced to just $500,000.

Now let’s look at HSUS’s 2009 Consolidated Financial Statements—an audited, combined statement of the financial position held by HSUS and its affiliates. That reports shows a curious $16.2 million increase in HSI’s “International Program Support” revenue, which is offset by a category called “eliminations.” For you non-accountants, an “elimination” is basically a write-off that covers up the impact of back-and-forth transactions among related parties. (See page 27.)

We showed all our paperwork to two Virginia CPAs and asked for their opinions. Here’s what they think is going on:

It definitely seems that the majority of the debt from HSUS and its related entities to HSI has been forgiven, and HSI is recognizing the relief of that debt as “income.” The bigger question is this: Did the contributors to HSUS and its related entities know their money was going to be used on foreign projects, and to forgive an affiliate’s debts?

In other words, HSUS and its related entities have been fronting costs for Humane Society International for years. This arrangement allowed HSI to keep operating even though it was, technically, broke. HSI kept accruing more and more debt, of course. And in 2009, HSUS (speaking for itself and all the HSUS-related organizations) wiped the slate clean.

It helps, of course, to remember that HSI and HSUS are controlled by essentially the same handful of people. So transactions like this would be a simple matter of the left hand paying the right. It’s perfectly legal.

But here’s where it gets sticky: If we’re on the right track, and HSUS gave Humane Society International a massive get-out-of-debt-free card, then HSUS’s American donors are paying for international programs. These would include a junket to Cancun for a global warming conference and a campaign that pushes cage-free eggs in India.

Somehow, that didn’t make it into HSUS’s “$19 a month” commercials.

As time goes on, we’re learning about more and more programs that HSUS’s contributors are unknowingly paying for. Do they mind? Would they feel baited-and-switched? Who knows? But we doubt HSUS is about to ask them.