1988 Letter from Accountants Thomas Havey & Co. re: John Hoyt’s Rent-Free Use of an HSUS-Owned Home

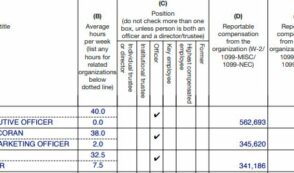

In this October 1988 letter, the accounting firm of Thomas Havey & Co. reviewed the tax implications of allowing HSUS president John Hoyt to live (rent-free) during 1987 in a house owned by HSUS. HSUS had purchased the home from Hoyt for $310,000, and then “leased” it back to him for zero dollars.

In this October 1988 letter, the accounting firm of Thomas Havey & Co. reviewed the tax implications of allowing HSUS president John Hoyt to live (rent-free) during 1987 in a house owned by HSUS. HSUS had purchased the home from Hoyt for $310,000, and then “leased” it back to him for zero dollars.

For tax purposes, Hoyt reported to the IRS that the rental value of the property was $600 per month. That estimate represented a significant perk for Hoyt. This letter reported “the fair rental value to be $1,200 per month.”

HSUS provided other financial benefits to Hoyt as well, paying the real estate taxes and special assessments on the property (valued at $3,575.65 for 1988), as well as casualty and liability insurance and repairs costing more than $100.