HSUS Dogged By Calls for Short IRS Leash

The more HSUS pushes a PETA-like agenda, the more scrutiny it attracts. Last summer we reported on a letter U.S. Rep. Blaine Luetkemeyer (R-MO) sent to IRS Commissioner Douglas Shulman to convey his concerns about HSUS’s extensive lobbying activities. (Luetkemeyer followed up by writing to the IRS’s Director of Exempt Organizations.) Congressman Pete Visclosky (D-IN) later forwarded the IRS Commissioner a letter from one of his constituents who raised additional concerns about HSUS’s political interventions.

The more HSUS pushes a PETA-like agenda, the more scrutiny it attracts. Last summer we reported on a letter U.S. Rep. Blaine Luetkemeyer (R-MO) sent to IRS Commissioner Douglas Shulman to convey his concerns about HSUS’s extensive lobbying activities. (Luetkemeyer followed up by writing to the IRS’s Director of Exempt Organizations.) Congressman Pete Visclosky (D-IN) later forwarded the IRS Commissioner a letter from one of his constituents who raised additional concerns about HSUS’s political interventions.

Now a cadre of six Members of Congress—including more than half of Missouri’s Congressional delegation—are demanding a thorough federal investigation into HSUS’s tax-exempt charitable status.

On April 18 Leutkemeyer; Alaska’s Don Young (who refused an award from HSUS just three weeks ago); and Missouri’s Billy Long, Sam Graves, Jo Ann Emerson, and Vicky Hartzer (all Republicans) wrote to U.S. Treasury Inspector General Eric Thorson that during “the past two years, [HSUS] has conducted substantial political activities within Missouri that brought into question its tax-exempt 501(c)(3) status.”

Could a major setback for HSUS be coming?

The six federal legislators are asking Thorson, the ultimate investigative authority on the federal tax code, to look into whether the Humane Society of the United States’s lobbying activity violates its charitable status, noting that (to their knowledge) the IRS did not take any action following Luetkemeyer’s letters to the IRS last year:

We believe that HSUS’s own public documents show beyond question that lobbying is a “substantial part” of its activities, and feel that the IRS’s failure to act is attributable to the politically sensitive nature of HSUS’s activities.

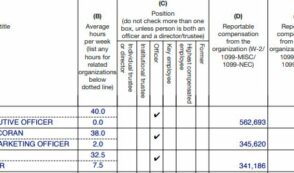

Specifically, the Members of Congress take issue with HSUS’s admission that it spent over $26 million on “Advocacy and public policy” in 2009 alone. Additionally, they write, HSUS “spends more than twice as much on ‘Advocacy and public policy’ than any other category of expenses.”

It’s unclear whether the IRS investigated HSUS after Luetkemeyer’s 2010 requests. (For all we know, there may be an investigation already underway.) But between forceful opposition to HSUS in the Nebraska legislature and in the Missouri statehouse, and this latest move, it’s clear that the issue isn’t going away anytime soon.

There’s certainly a compelling case to be made that HSUS spends far too much time and money on lobbying activities. It certainly doesn’t send nearly enough money to pet shelters.

The devil is in the details, though, and it will be interesting to see how deep the Inspector General is willing to dig. If HSUS loses its exempt status, the IRS can assess back taxes and penalties. Not only would HSUS no longer be able to attract donations with the promise of a tax deduction, but it could have an enormous amount of back-taxes to pay.

It’s important to note that tax-exempt charities are permitted to do a limited amount of lobbying. The Humane Society of the United States can operate within the letter of the law, for instance, while spending some money on lobbying.

But the letter from this particular “gang of 6” is arguing that HSUS has far exceeded those regulatory limits. Just as there are plenty of questions about how HSUS accounts for its fundraising expenses, its political spending will clearly come under some sort of microscope soon.

There may be a consensus forming that animal rights groups in general are prone to abusing their special tax status. Canada’s federal government drafted new regulations in February that would change the law dramatically. Under the proposed rules, in order for animal advocacy to be considered charitable, “the benefit to humans must always take precedence over any benefit to animals. If a purpose or activity that promotes the welfare of animals harms humans, or has a real potential to cause significant harm to humans, it is likely not charitable.”

It’s clear that HSUS and Humane Society International couldn’t continue to receive a tax benefit in Canada under this sort of system. (And with the Conservative Party’s strong showing in yesterday’s Canadian elections, the new regulations could be finalized very soon.)

The real question is whether or not the U.S. Treasury Department could ever move in Canada’s direction. Or has the Humane Society of the United States already over-lobbied its way to some sort of special protection?